INSIGHTS

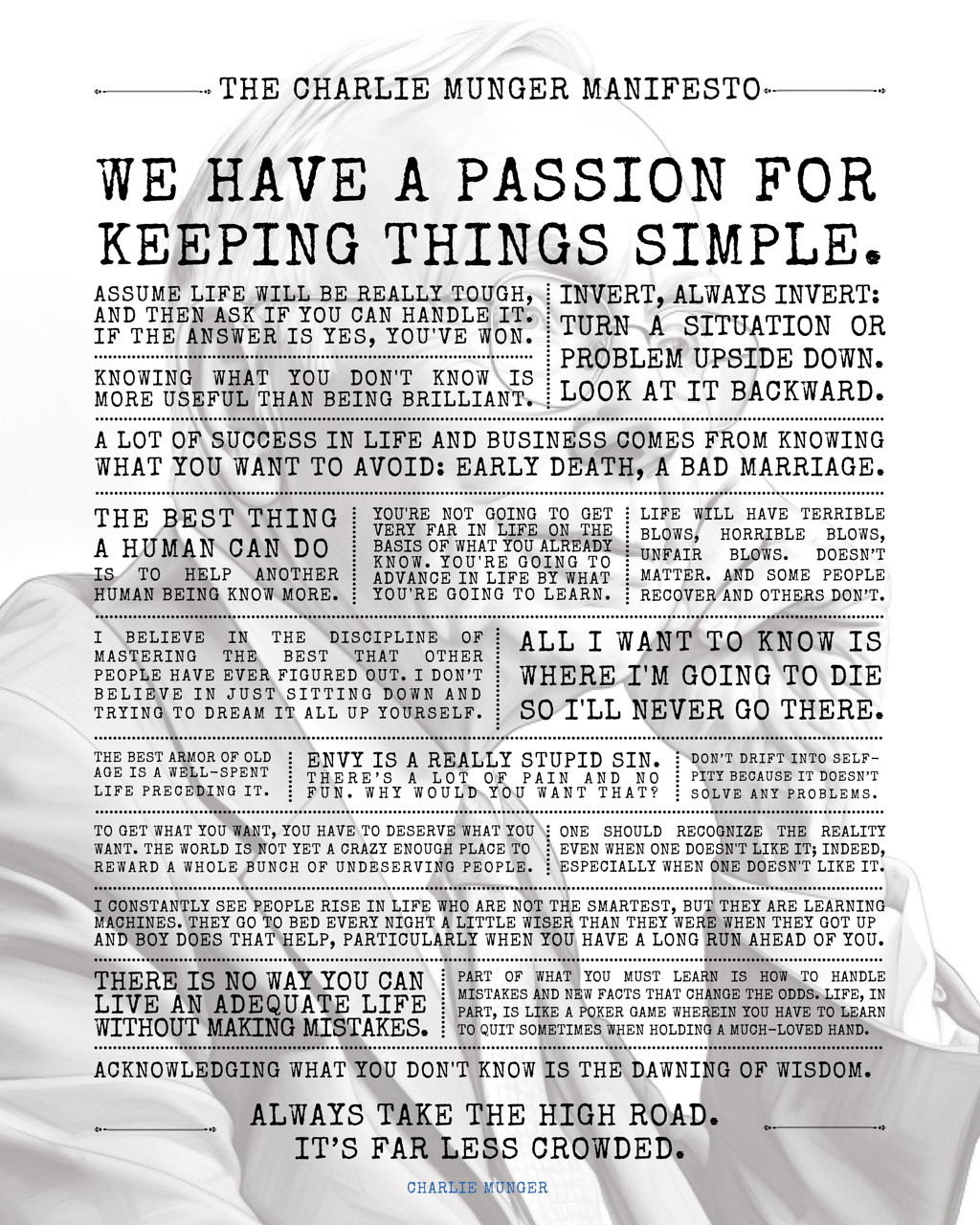

Chart of the Week (not exactly a chart)

Source: Vishal Khandelawal; http://safalniveshak.com

Asset Class Analysis: FARMLAND

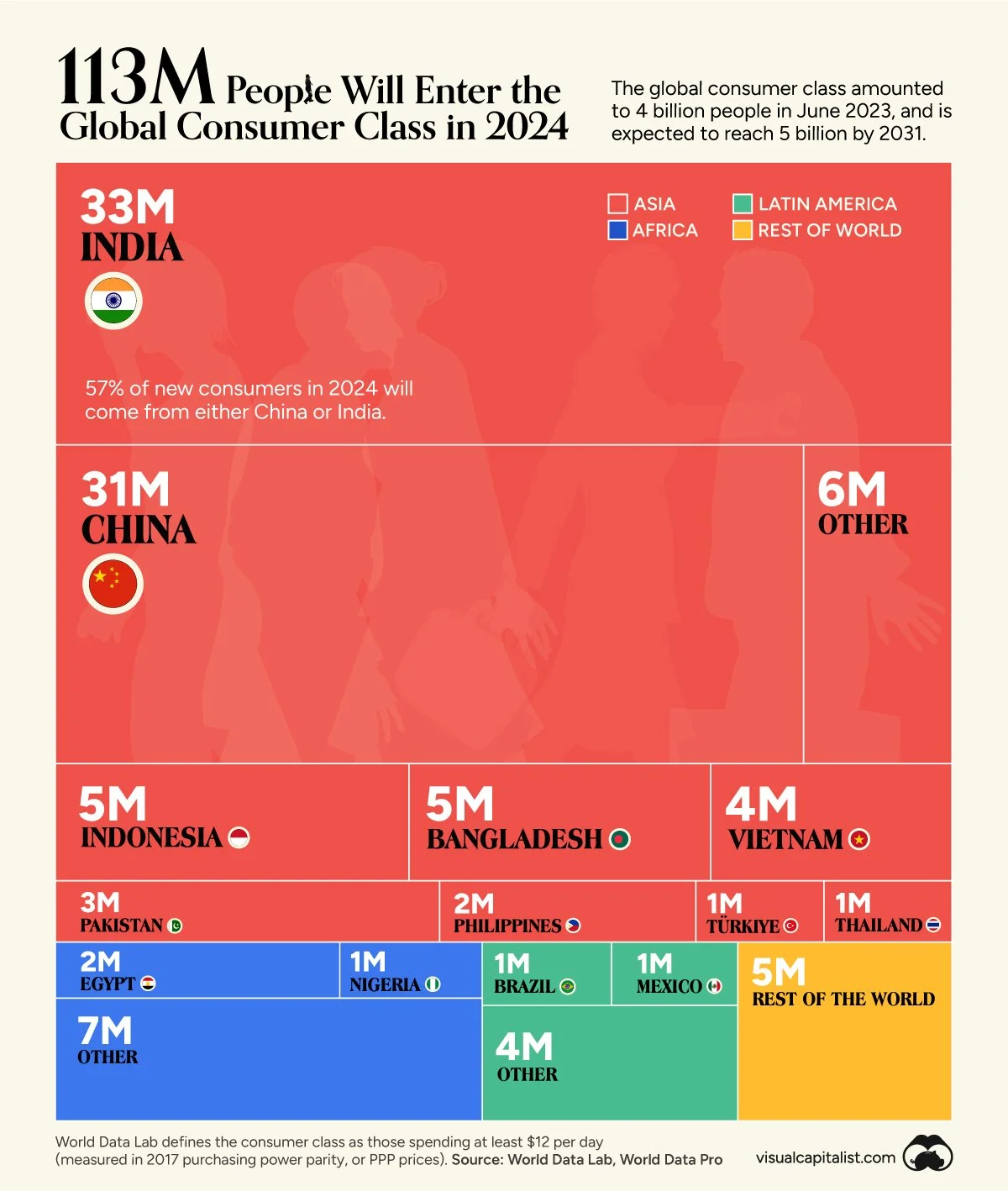

Farmland is a resilient and reliable investment that warrants a place in investor portfolios. Real assets are currently undervalued relative to financial assets globally. Farmland falls into the real assets category and is under-allocated by institutional investors despite generating attractive risk-adjusted returns and providing stability in times of heightened volatility. This relative undervaluation is at historically elevated levels, providing an opportunity for investors.