FUND UPDATE: SPOTIFY

Investors in the Elevation Capital Global Shares Fund have owned a share of Spotify since November 2018. Due to a combination of recent acquisitions, namely exclusive rights to Joe Rogan’s podcasts, and a global pandemic that has further accelerated consumers trend toward streaming, Spotify to date has returned +118.29% from the Fund’s cost basis.

We published our initial research report on Spotify on 9 April 2020 that pointed to podcast acquisitions as a key path to long-term profitability for Spotify. For a more detailed analysis of Spotify, read our updated report here.

VISA - IT’S EVERYWHERE YOU WANT TO BE

Investors in the Elevation Capital Global Shares Fund own a share of Visa Inc. [V], a multinational payment facilitator who has issued over 3.2 billion cards to date. The Fund added Visa to our portfolio during the recent market sell-off. Visa one of the world’s largest companies by market capitalisation and has been playing a vital role in assisting governments and businesses navigate through this volatile period. The use of cash is declining while e-commerce and digital wallets are on the rise aided by the proliferation of smart-devices and improved offerings by companies like Amazon and Shopify. Visa is well positioned to capture the increase in payment flows through its financial ecosystem as a result of changing consumer and business behaviour.

Learn more about why we believe Visa represents a compelling long-term investment opportunity by reading our summary report here.

HIGHLIGHTING FARFETCH

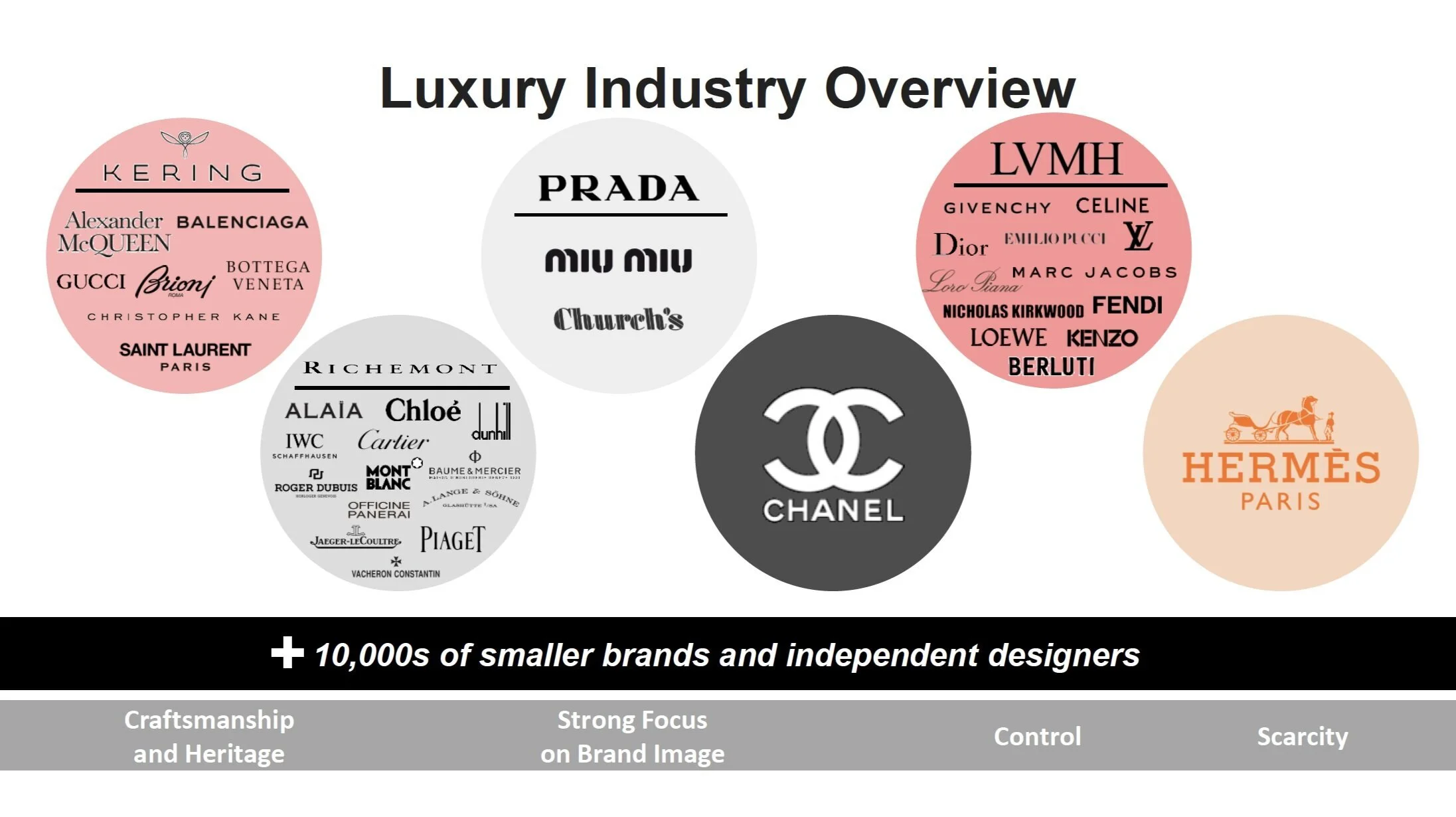

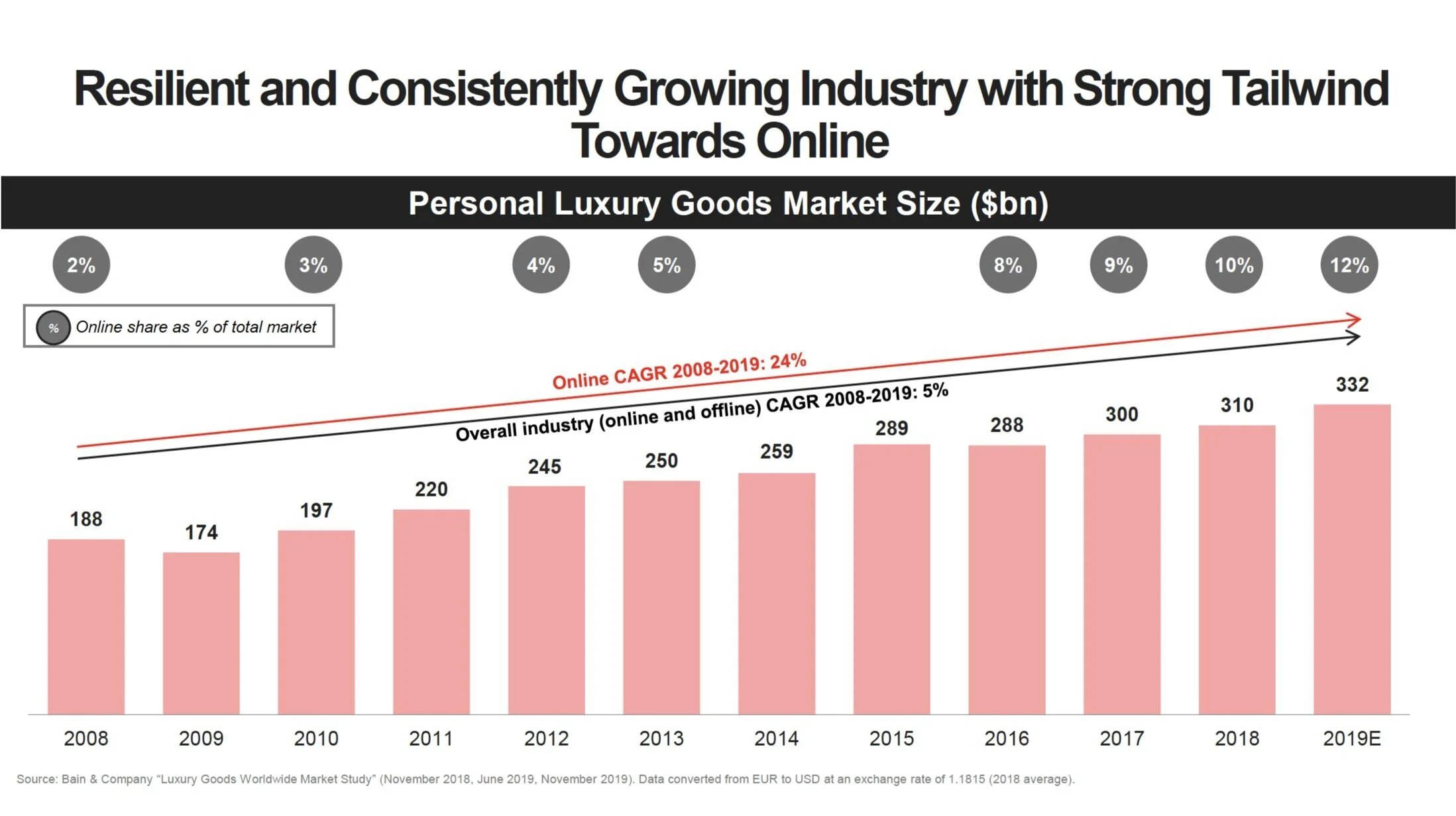

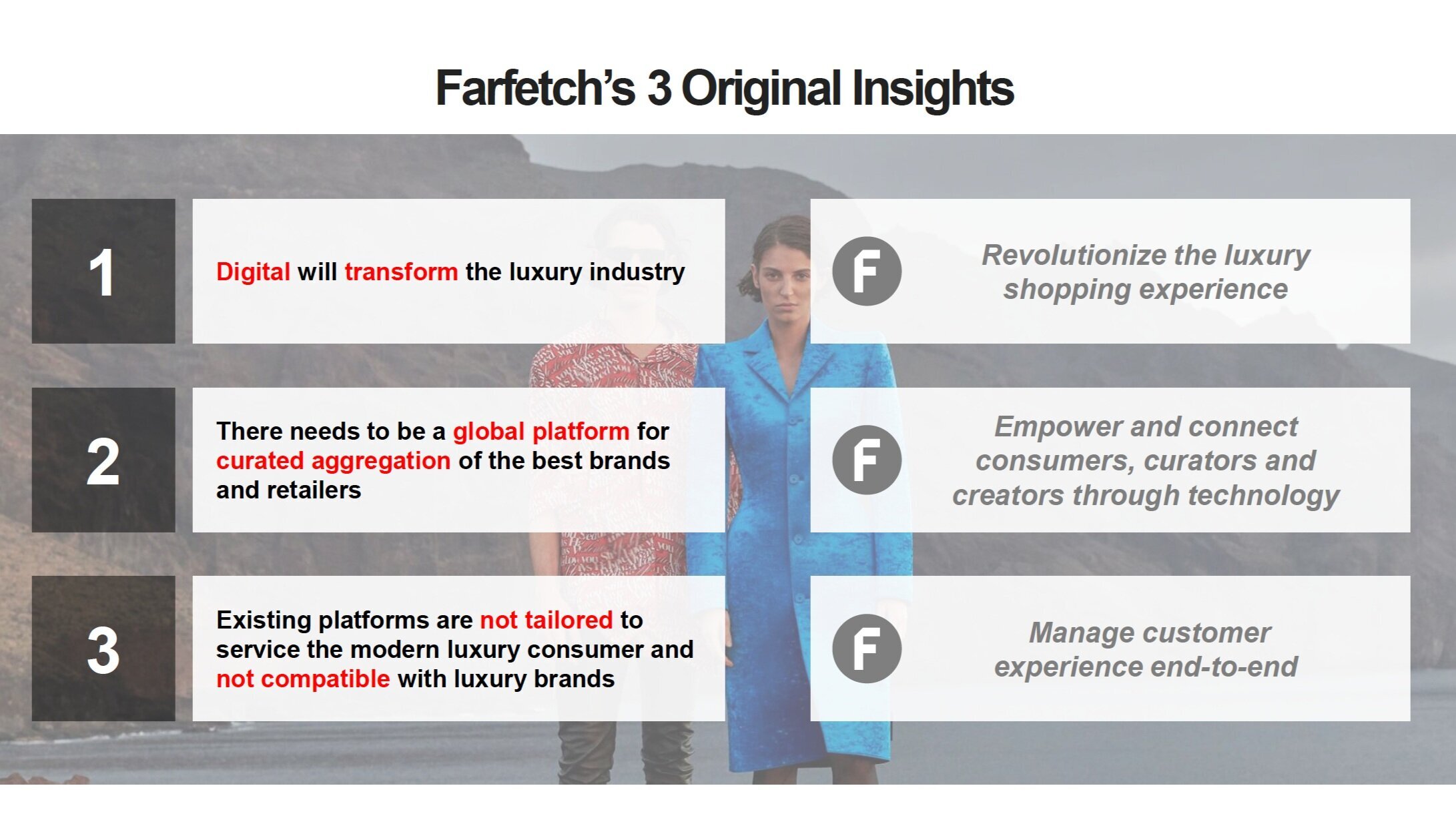

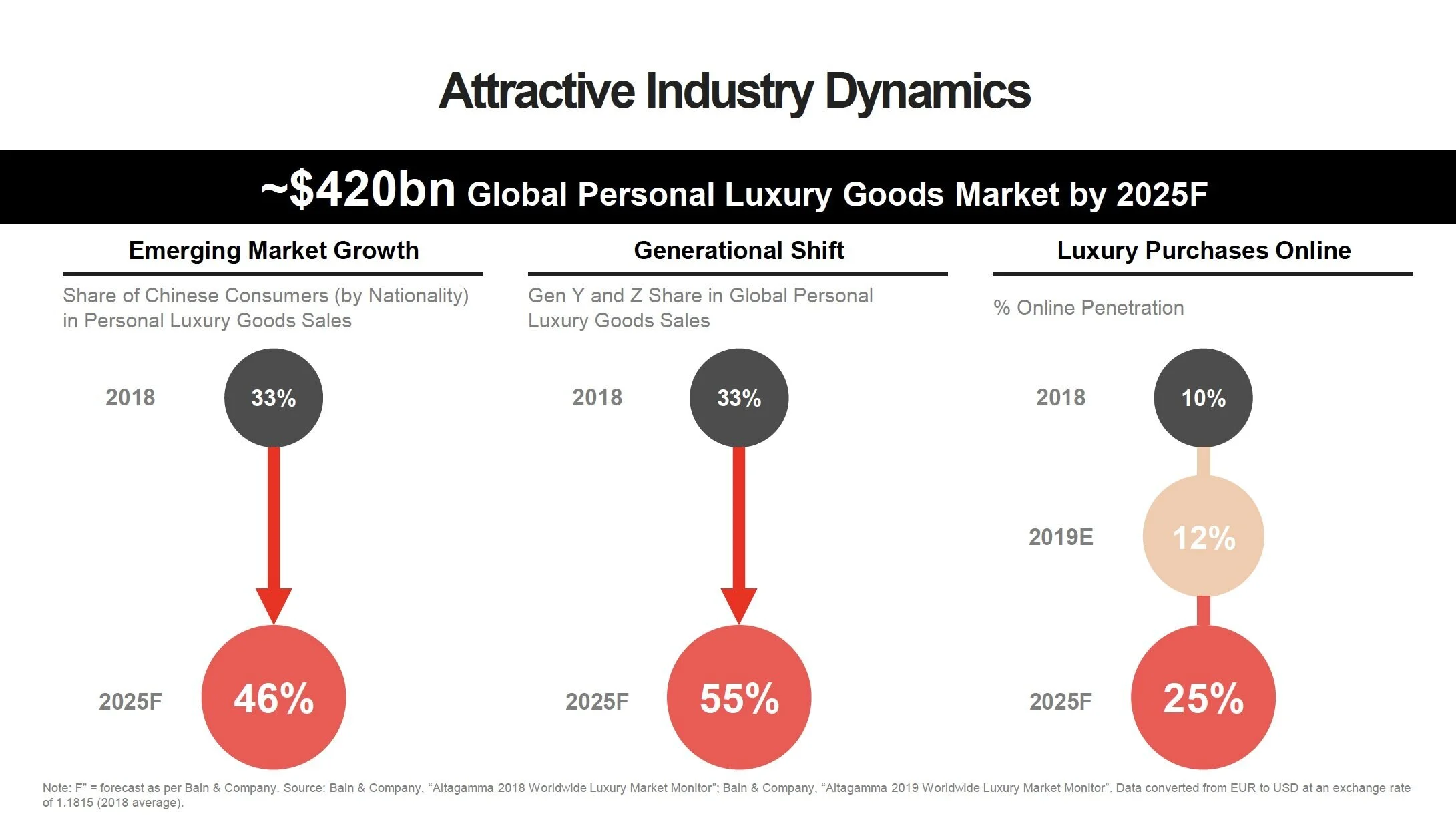

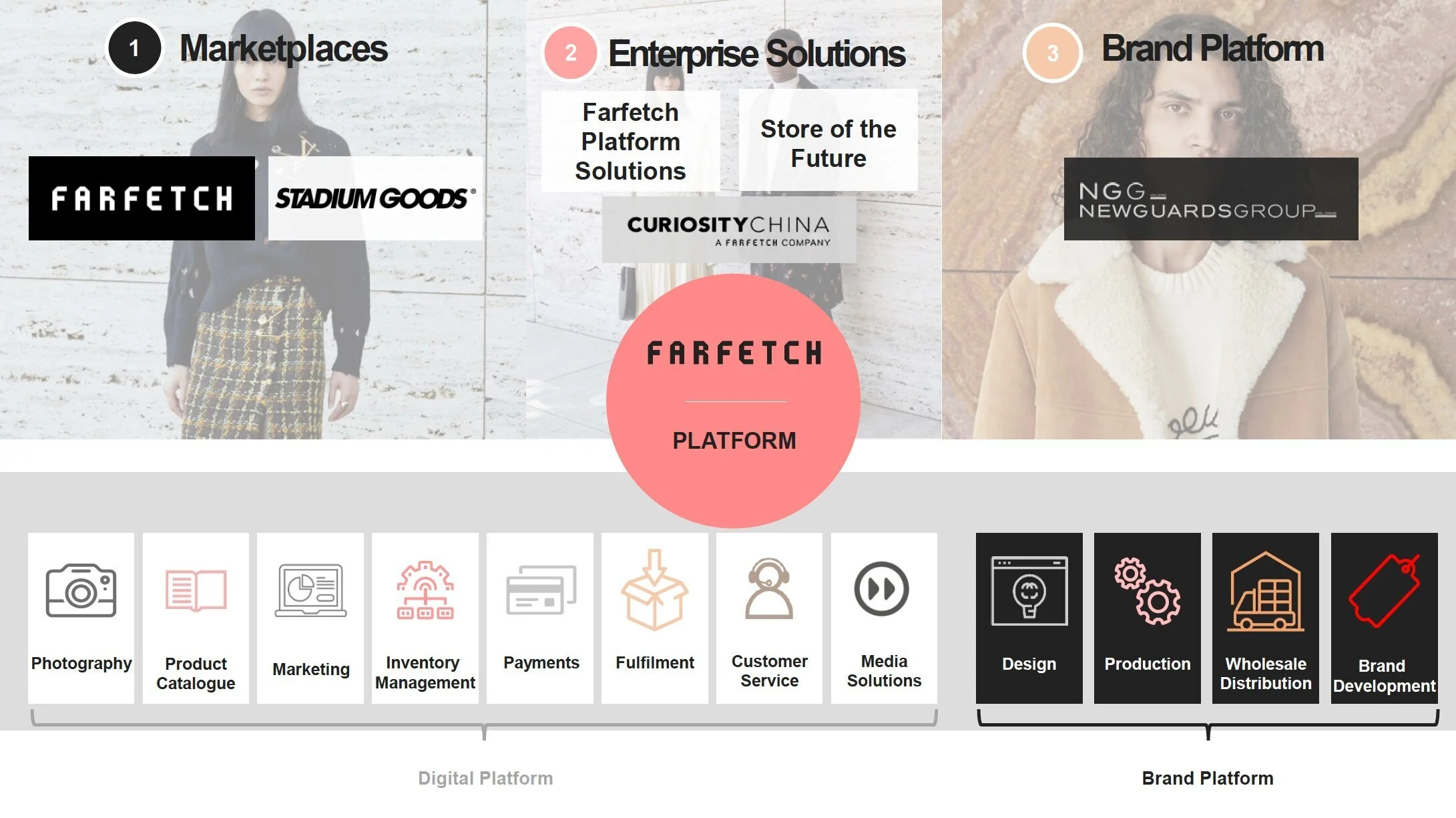

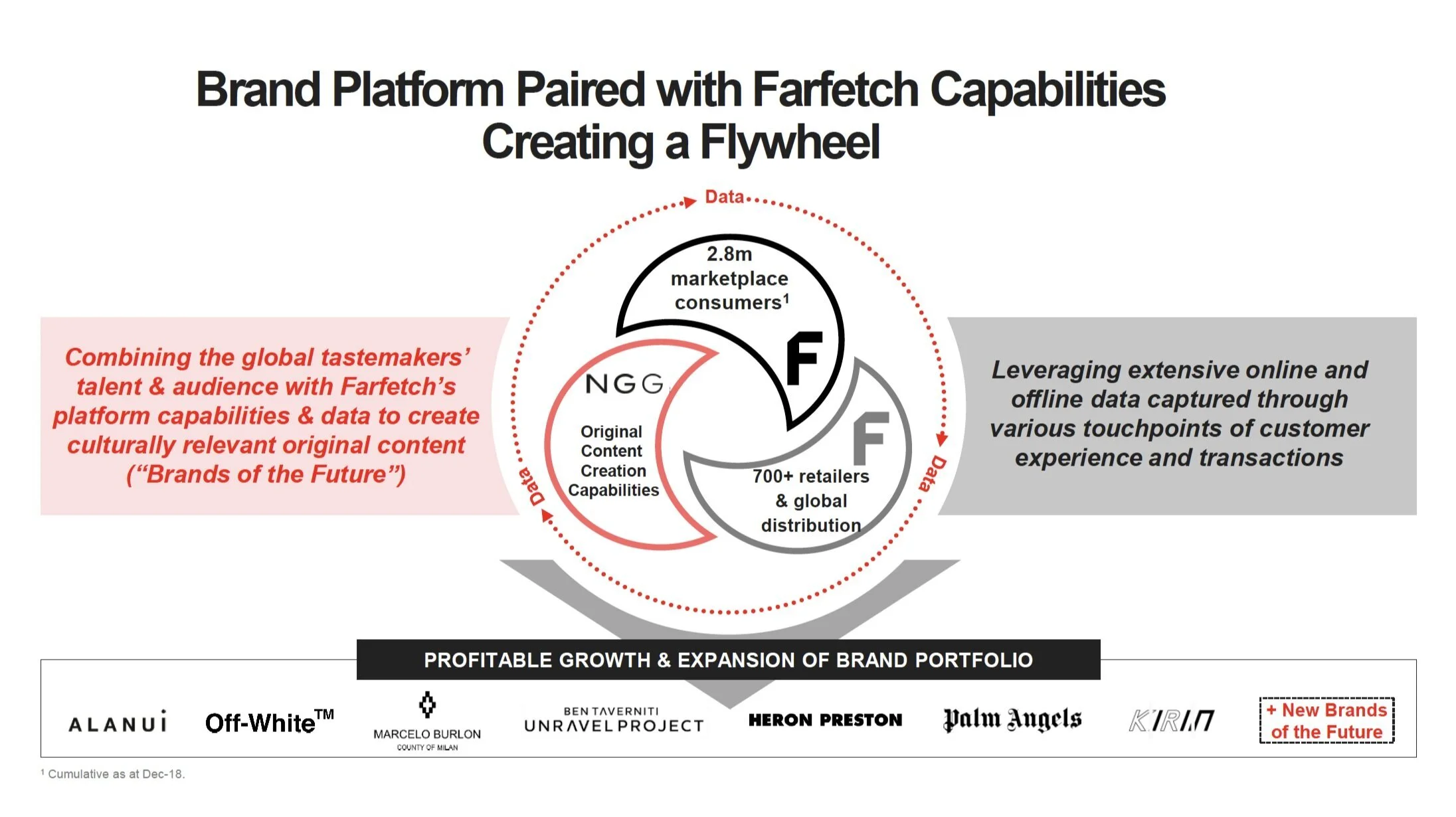

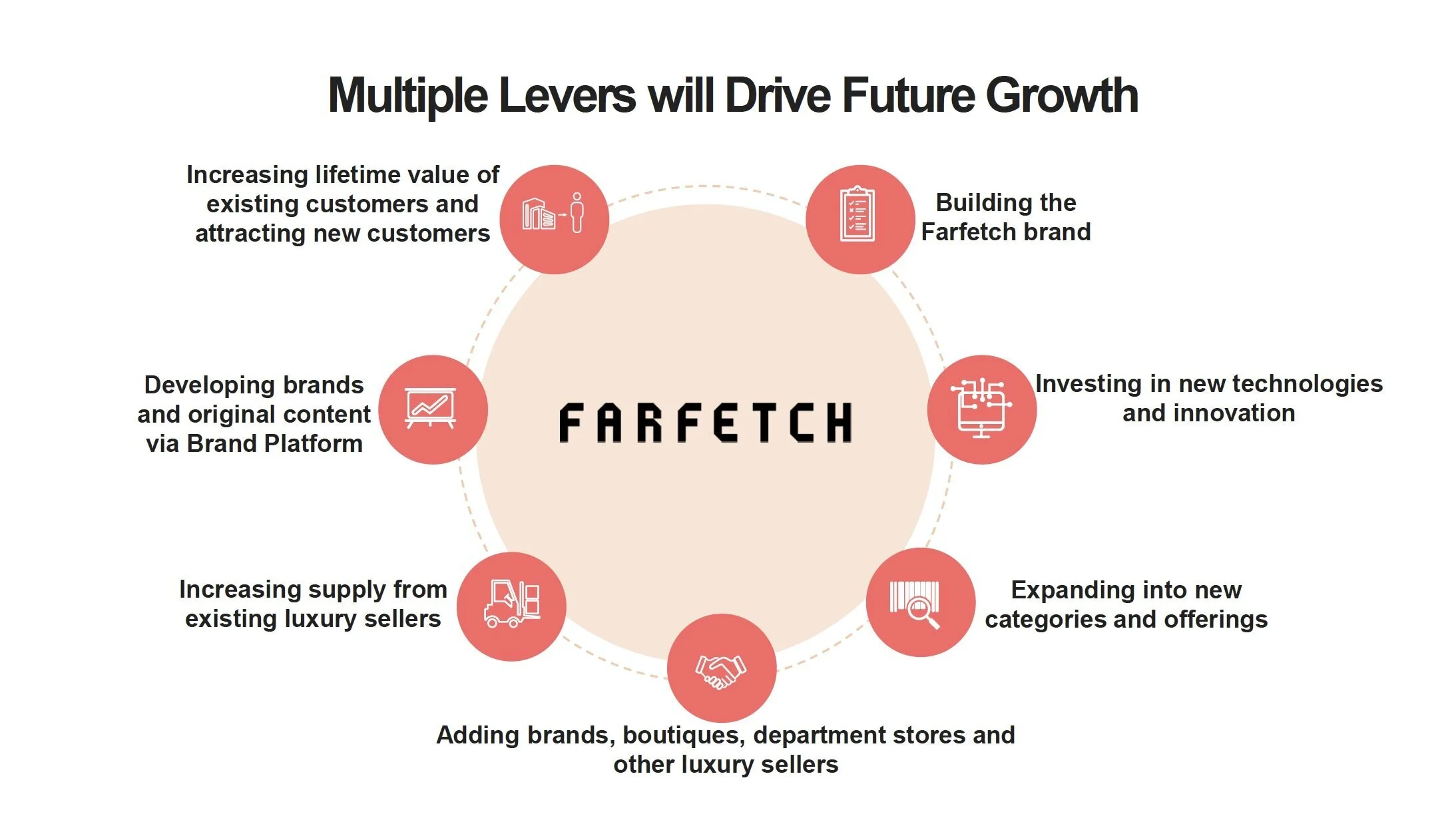

Investors in the Elevation Capital Global Shares Fund own a share of FarFetch, a global technology platform for luxury fashion that combines global tastemakers talent & audience with FarFetch’s platform capabilities & data to create culturally relevant original content (“Brands of the Future”).

LAUNCHING NEW ZEALAND RURAL LAND CO

Elevation Capital is pleased to announce the launch of New Zealand Rural Land Company (NZRLC). NZRLC is a newly formed entity seeking to take advantage of the current depressed market conditions for rural land caused in part by credit restrictions to the sector and limitations on foreign investment. NZRLC will seek to acquire carefully selected rural land and lease the land back to high-performing operators, improving capital efficiency within the sector and allowing farmers to do what they do best.

You can learn more about NZRLC here.

HIGHLIGHTING FEVERTREE DRINKS PLC

The Elevation Capital Global Shares Fund acquired a share of Fever-Tree Drinks PLC in the recent market sell-off. A company with a strong balance sheet that is well-positioned to weather the current economic environment and continue to flourish.

Already returning +49.67% for the Fund since 27 March 2020 when we acquired our interest at a near 3-year low. Below we highlight the key company features that led to our decision to acquire an interest in the company.

FORBES 30-UNDER-30

Former Elevation Capital Intern - Andy Chan - has been included in the Forbes 30 Under 30 for co-founding Qupital, a Hong-Kong based start up that offers short-term lending and liquidity to companies and matches them with investors interested in covering the loan.

The team at Elevation Capital would like to congratulate Andy on his success, and wish him well on his journey forward. Elevation Capital has had a longstanding dedication to furthering the careers of students since 2011, offering placements to carefully selected applicants. You can find a detailed list of our historical interns here.

ELEVATION CAPITAL'S #NZXNOW CAMPAIGN REVISITED

NZX Limited announced on 31 March 2020 a proposal to structurally separate the regulatory function from the company’s commercial and operational activities. The proposed entity will be governed by a separate board, with an Independent Chair. Elevation Capital views the separation of responsibilities by NZX as extremely positive.

In October 2018, Elevation Capital released #NZXNOW (www.nzxnow.com) with a list of recommendations the company could undertake to improve profitability. Included in this was separating the regulatory functions of the organisation.

NZX remains a core holding of the Fund accounting for 2.25% of the portfolio as at 30 April 2020. We are pleased to see NZX taking proactive steps to enhance the business which will improve shareholder returns. We look forward to future value enhancing initiatives from the company and continue to engage with them accordingly on behalf of our investors.

SPOTIFY - REIMAGINING MUSIC

Elevation Capital Global Shares Fund investors own a share of Spotify Technology S.A. [SPOT], a global audio streaming service that has revolutionised the way music is accessed.

Spotify is the largest audio streaming platform in the world and is experiencing year on year growth in users and revenue attributable to their unique service that utilises machine learning to personally curate playlists for each user. The music industry is growing both in terms of revenue and size, as emerging markets like China and Brazil are experiencing increases in demand. Spotify is helping to drive this growth, and are well positioned to benefit from the economic tailwinds in the music and streaming audio industry. The company recently announced a stock buyback, indicating a belief within management that the company is/was trading below its intrinsic value.

Learn more about why we believe Spotify represents a compelling long-term investment opportunity by reading our summary report here.

CHRIS SWASBROOK ON INTELLIGENT INVESTING IN CRISIS MODE: OPPORTUNITIES IN QUALITY BUSINESSES

On 2 April 2020 Managing Director of Elevation Capital was invited to share his opinion on investing during the outbreak of COVID-19. During the interview Chris sheds some light on how his investment approach is transforming in light of current events while maintaining his fundamental margin of safety principle.

COVID-19

Global markets are at the time of writing down over 20% in the past few weeks as market volatility has soared due to the crisis spawned by coronavirus (COVID-19). This is understandably unsettling for investors as markets have now fallen victim to another “black swan” in the form of a virus that has quickly developed into a pandemic.

The swiftness of the declines has caught even the savviest of investors off guard, including ourselves. Although this is the first time in modern financial history that a pandemic has caused a major financial market correction, it is not the first time that investors have endured a major shock.

Read our report on how we are navigating through these volatile times here.

SONY - MAKE BELIEVE

Elevation Capital Global Shares Fund investors own a share of Sony Corporation [SNE], a conglomerate which suffers from misplaced perceptions that it is still a slow-moving consumer electronics company.

The company has a long history of innovation which is still present in 2020. Sony dominates the gaming, music and semiconductor industries, all of which are experiencing significant economic tailwinds. As the company consolidates already profitable segments, divests from less profitable ones and invests in products facing significant increases in demand, Sony has many levers to pull for value creation to unfold.

Learn more about this business and why we believe it provides a compelling long-term investment opportunity by reading our Summary Report here.

THE REALREAL - THE RESALE FASHION DISRUPTER

Elevation Capital Global Shares Fund: Investors own a share of The RealReal [REAL.O], one of the largest online marketplaces for consigned luxury goods. The RealReal is leading the proliferation of a circular economy for fashion, giving additional life to luxury brands such as Gucci and Louis Vuitton. The RealReal’s unique flywheel means revenue can be expected to increase while maintaining costs by generating authentic reach turning buyers into consigners and vice-versa. The company has scalability and is positioned to benefit from the economic tailwinds in the resale industry.

Learn more about this business and why we believe it provides a compelling long-term investment opportunity by reading our summary report here.

ELEVATION CAPITAL’S RESEARCH FEATURED IN VALUE INVESTOR INSIGHT

Elevation Capital’s research once again featured by Value Investor Insight, a known favourite of Warren Buffett. The prestigious US publication highlighted our summary report on the Petcare Industry, the full report can be found here.

WELCOME TO 2020!

Elevation Capital wishes our investors and followers a Happy and Prosperous New Year. The Elevation Capital Global Shares Fund’s Top 10 positions* as we enter a new decade are as follows:

*as at 31 December 2019

ELEVATION CAPITAL GLOBAL SHARES FUND BIDS FAREWELL TO TIFFANY & CO.

The Elevation Capital Global Shares Fund divested its investment in Tiffany & Co. after Moët Hennessy – Louis Vuitton (LVMH) increased its bid to US$135.00 per share for the Company and the Directors recommended the offer. The fund held an investment in Tiffany for 7.61 years and generated a per annum (pa) return over the period of +18.4% p.a.