Why we own Visa and Mastercard

Investors in the Elevation Capital Global Shares fund own shares in both Visa and Mastercard. Recently both businesses have, in our opinion, been priced at a discount to their intrinsic value. We thought it pertinent to talk about why we think Mastercard and Visa are some of the best businesses in the history of mankind, and why we are buying more -- if you’re being offered a chicken that lays golden eggs, you take the chicken.

Here is why we like Visa and Mastercard so much. We like very simple businesses. A simple business model often equates to superior business performance. We then think about companies which are likely to generate meaningfully more amounts of money in the next ten years than they do now. Let’s borrow Charlie Munger’s phrasing and call these the “probables”. It’s much easier to understand something that’s probable when it’s simple. Mastercard and Visa are the epitome of simplicity - they are in the ticket clipping business.

They clip the ticket on every transaction made via their vast networks -- often they clip the ticket twice, or three times -- for money to travel from a consumer to Merchant X, the money moves from the consumer’s bank to a merchant bank, possibly several times depending on the complexity of the money’s journey. Visa and Mastercard clip the ticket every time the money travels. The percentage they take is tiny - an average of .15% - but they take that .15% every time. They earn a royalty anytime someone uses their network.

This has been hugely profitable for Visa and Mastercard. Payments using cards have ballooned over the last few decades as they have become integral to everyday use -- a hundred years ago leaving the house without your cash or chequebook seemed unthinkable. Now leaving the house without your card (whether it is physical or on your phone) is unthinkable. For all intents and purposes, cards are our main form of money.

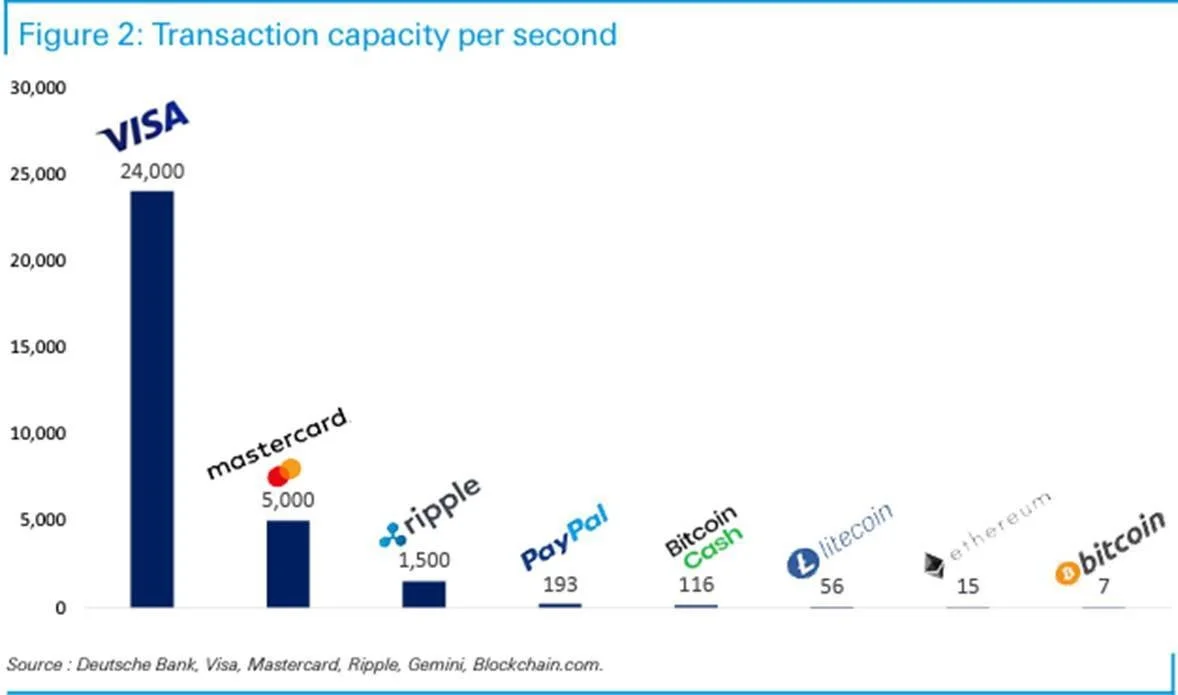

This is partially due to ease of use. Cards are portable and light and often weightless -- our card details are so often saved on our devices that we don’t need to access the physical object itself. This is also partially due to accessibility: Visa alone is accepted in 54 million locations; Mastercard’s is similar. Visa can process 24,000+ transactions per second (Bitcoin, for the crypto-enthused, processes around just 7). It is so blindingly omnipresent that it can be hard to realise what an incredible accomplishment this is. Visa and Mastercard have woven a network that encompasses the entire world

Here’s the rub: the web that Visa and Mastercard wove is complicated; it’s as if they have constructed not a moat but a labyrinth, filled with minotaurs -- Visa’s own proprietary technology, VisaNet, was first rolled out in 1973. It covers thousands of banks and millions of merchants. It’s a network which is hard to replicate, which explains why the two companies have enjoyed such a strong competitive advantage for so long -- in America, Visa commands a 49% market share and Mastercard 38%. Worldwide market share is similar, adjusted to exclude the Chinese market. American Express’ market share is only 3%.

The growth opportunity is one of simple arithmetic. More people using electronic payments means a greater transaction volume, which means Visa and Mastercard’s cut is proportionally larger. In 2010, 28% of consumer purchases were made on cards. By 2018, 48% of transactions were via card. The figure now hovers closer to the mid-50s. So here are our “probables”: it’s probable that the world’s population will increase, it’s probable that spending will increase, therefore Visa and Mastercard stand upon a stream of ever-increasing royalties, like a fly fisherman in a stream which becomes continuously surrounded by more and more fish.

In other words, the continued growth and continued economic prosperity of the world is a boon for Visa and Mastercard. It is hard to argue that our quality of life now is better than a century ago, or five hundred years ago (you might be interested to know the average life expectancy in the US in 1921 was 60 -- it’s now 80. 500 years ago it was about 35). Humanity continues to innovate and expand, and fully expect Visa and Mastercard will be there to clip the ticket.

The second opportunity is B2B (business to business) payments. Mastercard estimates that $120 trillion flows through the B2B market. Visa recently broke $1 trillion in B2B payments; their management estimates we are in no more than a “second innings” and the market opportunity is at least ten times current payment flows (ie. $10 trillion -- this still represents a small fraction of the overall B2B pie). The two companies have wasted no time in their pursuit of B2B -- in 2019, Visa launched the Visa B2B connect and Mastercard launched its own service, Mastercard Track. The value proposition they offer is similar to what they offer consumers: faster, more certain transactions paid on time. We should mention that Visa and Mastercard’s transaction fees are lower than their competitors.

A few learnings from the rise and rise of these two stalwarts, then --

i), The death of traditional cards by “fintech” disruptors has been greatly overstated. For instance, Nubank - the much lauded “new” bank with no branches and no fees which lists on the NYSE on 8 December - still uses Mastercard for their bank cards.

ii), The prestige card - American Express - has largely been a victim of its own prestige -- as per a 2017 NYTimes article - Amex, Challenged by Chase, is losing the Snob War:

But it’s an uphill battle for Amex, in part because the company is fighting an image of conspicuous consumption it has cultivated for decades. Amex sold a dream about what success looks like, a universe where handsome men and glittering women murmur about second homes over decanters filled with expensive booze.

iii), The physical quality of a card matters less and less - it is often on our phone, via NFC (near field communication chip), or used to make payments online. This explains partially why American Express’ moat has eroded so significantly in the last decade, as previously physical things have become more and more digitised.

iv), There are two big growth opportunities here: the continual shift to spending using cards, and the B2B opportunity.

v), Visa and Mastercard are the best positioned operators to take advantage of rising consumer spending and a growing population. To borrow for Munger again, they are “probables”.