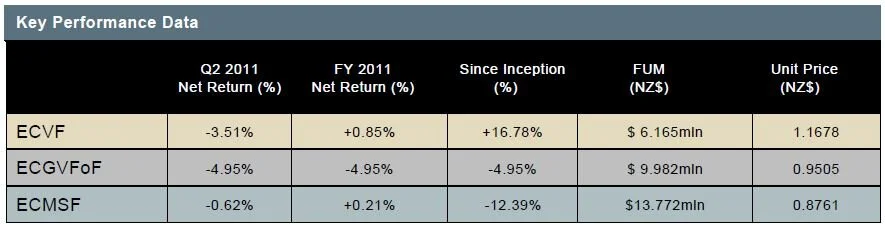

ELEVATION CAPITAL - SECOND QUARTER REPORT

Q2 2011 Commentary

Our Funds delivered negative returns during Q2 2011 primarily due to the NZD appreciating further against the USD (and other currencies). Over the quarter the NZD / USD cross rate rose from 0.7640 – 0.8261 (+8.13%). In July this rallied continued with the currency +6.44% to 0.8793. To provide some comparison to the Fund/s performance the MSCI World Value Index (NZD) declined 8.56% during the quarter and then suffered a further 8.58% decline in July alone. At the end of the quarter, all three of the Elevation Capital funds remain conservatively positioned with net cash balances of 29.7% for ECMSF, 22.6% for ECVF and 10% for ECGVFoF.

Our underlying portfolio of investments continue to outperform despite the significant volatility which reflects the fact we remain focused on well financed and dividend paying companies on a worldwide basis – the same applies for the underlying managers we have selected in ECGVFoF.

During the quarter we initiated new positions in the following stocks: Delta Lloyd (ECVF), Italcementi (ECVF), Total (ECVF), Titan Cement (ECVF). We also received a new position in Berkshire Hathaway (BRKB) as we accepted Mr. Buffett’s takeover for Wesco Financial (WSC) during the quarter.

Current Quarter Commentary

We delayed the release of this quarterly letter to provide a more up to date picture of what has transpired through late July and early August 2011. Our Fund’s showed further negative returns in July (see respective month end summaries released today). However, it is important to distinguish that this was principally driven by the following factors:

Further NZD strength impacting both ECVF and ECGVFoF which hold all their international assets on an unhedged basis (Note: the NZD closed at 0.8793 at the end of July +6.44% over the month), and

Weakness in Heartland NZ on the back of its complicated capital raising to provide funding for the acquisition of PGG Wrightson’s finance operations. (Note: HNZ declined from NZ$ 0.68c to NZ$0.61c (- 10.3%).

Most importantly however, we entered August with robust cash positions and this has afforded us much opportunity.

Post S&P downgrading the US from AAA (this downgrade occurred at 9pm EST, 5 August 2011) we have witnessed market volatility which takes us back to the harrowing months post September 2008 and the collapse of Lehman Brothers. What many may not appreciate is that these wild swings in the market are increasingly driven by what is referred to as “algorithmic trading” or as the stock-broking industry refers to them “algo’s”. These computers now account for greater than 50% of daily trading on US exchanges and their holding periods are measured in seconds/minutes not hours. One also only need to turn to CNBC to hear the diatribe of short term emotional views being postulated across the television screens to further compound ones fears if your focus is not on such fundamentals as balance sheet strength, cashflow and dividends.

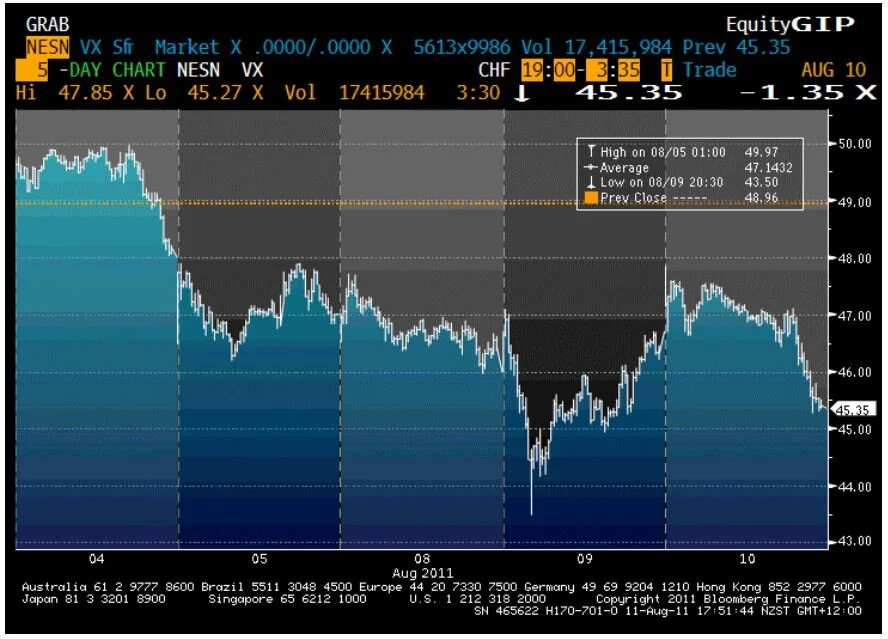

To provide you with some context around the impact of these trading programs and the “shoot from the hip” mentality that is now widespread we thought it might be useful to provide you with the trading data on Nestlé for this past week. Remember this is one of the world’s great food companies, with a portfolio of brands second to none and a fortress like balance sheet.

Nestlé on the 5th August traded as high as CHF 49.97, on the 9th August it traded at an intraday low of CHF 43.50. This price action implied that Nestlé’s market capitalisation had declined by ~13% in 3 business days. Even taking into account a potential global slowdown we doubt this is actually reflective of the true economic impact on Nestlé.

On Monday, 8th August and Tuesday, 9th August we purchased ~27 and ~30 stocks across the globe. This was the most active period we have ever had at Elevation Capital.

New positions we have initiated included the following: Kraft, Exxon, Nestlé, Imperial, Consolidated Media, Viterra, Premier Foods, and Supervalu.

We would emphasise these new positions are not large (typically 0.50% - 1.00%) positions, but in all cases the value on offer is compelling (in our opinion). However, we have been extremely cautious not to expend all our cash as we continue to believe the current market volatility will remain for a period of time. Furthermore, you will see we are very focused on what one can only be described when compared to the New Zealand market as global large-cap companies. It is here that we continue to find compelling valuations in companies with entrenched global franchises, strong balance sheets and consistent dividend histories. One can expect many of these holdings to remain with the Fund/s for a period of time measured in years (not weeks / months).

Is the United States in decline and should our focus turn to China?

Clearly, the most important factor impacting markets for some time now is the debate around the US debt ceiling and the weakness in the US Dollar. There is little doubt that the wrangling by the political parties in the US has downgraded the reputation of the United States of America in the eyes of many. Fortunately for them, the US Treasury market is the core asset of the financial world and there are few alternatives as is evidenced by the 10 year yield falling as low as 2.17% at the time of writing. (On 31 March 2011 it stood at 3.47%). A few other interesting points on this topic which continues to highlight the importance of the US Dollar’s reserve status:

The US Dollar currently represents 60.7% of the world’s currency reserves, compared with the 26.6% for the euro (Source: IMF);

10 year US Treasury yields are now well below the 4.05% average yield over the past decade and compares to the average yield of 5.48% when the US was running a budget surplus from 1998 – 2001 (Source: Bloomberg);

Fears of a yield “blow-out” maybe exacerbated at least in the short-term. According to JP Morgan Chase, Ten-year yields for the nine sovereign borrowers that have lost their AAA ratings since 1998 rose an average of two basis points in the following week.

The US accounts for one-third of global stock and bond market capitalization but represents two-third’s of market turnover – global capitalism flocks to the US markets on a daily basis (Source: IMF);

There is much debate all over the world at present as to whether the US can retain its status as the number one destination of investor capital and ultimately its status as the world’s reserve currency system now that it has lost its AAA rating (Note: S&P put a AAA rating on the US in 1941, S&P revised the US sovereign credit rating to negative on 18 April 2011, and downgraded its rating on 5 August 2011)). The consensus view now seems to be the US is in long-term decline and we are witnessing their demise in slow-motion.

Please find detailed below a link to a video produced by Mary Meeker at Kleiner Perkins Caufield & Byers which analyses USA Inc. and highlights how a businessperson might look to address some of the issues now facing the US. This video is +40mins in duration but it is worth allocating the time to watch and understand (in our opinion). It is supportive of our view that with some sensible policies and analysis the US can address both its budget imbalance and its long-term debt.

http//:www.kpcb.com/usainc/

At Elevation Capital we continue to hold the view that there are a number of tools available for the US to utilise provided the political establishment can muster some backbone – we have detailed two which are at the top of our list for consideration:

We have used the analogy many times in discussions with investors that when we fly to the US from New Zealand we can land at one of three airports – LAX, San Francisco, Dallas. None of these airports have been privatised they are still owned by the local authority (state). Despite being the global bastion of capitalism the US has embarked on very little privatisation. Now may well be the time for a significant change of strategy in this regard. There are a number of large Asian and Arab sovereign wealth funds that would have significant interest in investing in key US infrastructure assets. Privatisation could release significant funds and would also address the concerns around the US’s ability to invest in its infrastructure over the long-term;

There also exists the potential to harmonise sales taxes across the US and generate substantial revenues. For example, according to the Peterson Institute for International Economics, “Even Greece, in the midst of severe economic crisis in 2011 and with a badly broken revenue system is expected to have general government revenue at 42.6% of GDP. The US general government revenue will likely be 30.5% this year.” The introduction of a New Zealand style GST was cited as a relatively efficient way to raise several percentage points of GDP in additional revenue in the Peterson Institute’s testimony to the US House Ways and Means Committee.

It seems to us the US needs a “Captain America” moment (this is aptly portrayed in the new Marvel comic movie release) where you saw the power of the US economy (and the industriousness of the people) during World War II. Clearly this requires leadership and political willpower for change which unfortunately seems to be lacking at present but investors should ask will this status quo prevail forever?

On the flipside a large number of investors now believe that China is on the path to surpass all others. Future predictions are notoriously difficult (excluding Nostradamus of course!). But it is worthwhile to consider the following when looking to draw a meaningful conclusion:

There has recently been a large amount of press about a Chinese company called Sino Forests which is listed in Canada and has been the subject of a scathing report by a short seller which saw the stock collapse. We offer no view on whether this represents an opportunity as we are more focused on what seems to be a regular occurrence amongst Chinese companies listed on overseas exchanges and their desire to “cook-the-books” and defraud investors. Fictitious cash was also recently recorded on the books of Longtop Financial Technologies a NYSE listed Chinese financial software company audited by Deloitte Touche Tohmatsu for not less than 6 years prior to the fraud being revealed;

China’s National Audit Office recently disclosed that 17 State Owned Enterprises (SOE’s) had mis- represented their financial data – (Note: these were SOE’s!)

The Chinese banking system is likely to face a significant increase in non-performing loans if the state left the banks to sort these out themselves then the repercussions for global growth could be significant;

The Xinhua News Agency recently reported that the cost of generating one kilowatt hour of electricity exceeded the price the generators sell to the grid companies. Therefore, the more electricity they produce the more they lose! This clearly explains why China Southern Power was one of the 17 SOE’s accused of “cooking-the-books!”

Now one can always find reasons to be positive or negative on any topic. The key from our perspective is “trees do not grow to the sky” and it is our job to err on the side of caution and look at investment opportunities where there is not a significant “crowd”. At present opportunity seems to be presenting itself for the long-term minded investor in the US and Europe. The current environment is not easy for any investor, but with it comes opportunity. The number of companies that now warrant further research has expanded considerably in a short period of time, there are also now opportunities to average-in on existing investments. However, what has not changed is we continue to focus on businesses trading at a discount to a reasonable estimate of intrinsic value, have robust balance sheets and a track record of paying dividends to shareholders. History has proven that this approach rewards the long-term minded investor, we see no reason to deviate from this path and we are happy to leave “direct” China investments to others.

Manager to propose a merger of EC Multi Strategy Fund and EC Value Fund

The Board of Elevation Capital Management Limited has reviewed the costs of running the Multi Strategy Fund and Value Fund as stand alone products and has formed the view that it would be in the best interest of all investors to consider a merger of the two funds. The primary reason for proposing the merger is to reduce costs to the investors. Based on our modeling, the Management Expense Ratio (all cost including brokerage) could be reduced by as much as 40% for ECMSF investors, and 29% for ECVF investors if the two funds are merged.

Next week you will be receiving all the associated documents for a unitholder meeting to vote on the merger and several amendments to the Establishment Deed for the Value Fund. We anticipate this meeting will be held in early September in Parnell, Auckland.

The continuing Fund under this proposal will be the EC Value Fund - we envisage this will be a ~NZ$ 17.5mln Value Fund, with a globally diversified portfolio of 90+ stocks and a lower overall cost structure / fee impost for investors. It is also reasonable to expect that this Fund may begin to receive research coverage from the likes of Morningstar which may enable it to increase its Fund Under Management, further reducing costs to the underlying investors.

We look forward to providing you with further information in the coming weeks. Thank you for your continued interest and support.

Yours Sincerely,

Elevation Capital Management Limited