INSIGHTS

Givaudan SA: The Flavours & Fragrances Frontrunner

Givaudan (GIVN:SWX, Market Capitalisation: CHF 26.59bn), is the world’s largest company in the Flavours and Fragrances (F&F) industry. A Swiss multinational manufacturer, Givaudan specialises in creating unique tastes and smells used in a wide array of consumer products, ranging from food and beverages to cosmetics and home care products. The company operates in two business divisions; Taste & Wellbeing and Fragrance & Beauty. Givaudan was officially formed in 2000, via a spin-off from global pharmaceutical giant Roche, listing on the Swiss Stock Exchange (SWX). Today, Givaudan maintains a leadership position within the F&F industry, commanding +18% global market share and operating in all regions of the world.

The Elevation Capital Global Shares Fund currently holds shares in Givaudan SA.

Kering SA - Luxury Conglomerate

Kering SA is a luxury conglomerate which owns Gucci, Balenciaga, Bottega Veneta, Yves Saint Laurent, Alexander McQueen and, a number of other renowned luxury brands.

Gucci just last week unveiled its new collection with a new designer: Sabato De Sarno.

Balenciaga with Demna at the helm continues to surprise.

Read our Research on Kering SA from July 2022 here.

Hérmes SA - Latest Fashion Show

Hérmes SA is currently the largest position in the Elevation Capital Global Shares Fund - watch highlights of their latest fashion show.

Read our Research on Hérmes SA from June 2022 here.

Moncler - Brand of Extraordinary

The Elevation Capital Global Shares Fund currently holds shares in Moncler Group.

Read our Research on Moncler Group from August 2022 here.

The Art of Investing: Introducing Adobe

Adobe (ADBE:NYSE) is a dominant player in the creative tools market, with a market capitalization of US$157.09B. Adobe's exceptional business model, enviable market position, and highly sticky products make it an attractive long-term investment opportunity. While concerns about the legacy business following its recent acquisition of Figma may have caused some volatility in stock price, Adobe's consistent growth and high retention rates make it an attractive long-term investment.

Introducing Rémy Cointreau

Rémy Cointreau (RCO: EPA, Market Capitalisation €8.25b) is a company that provides investors with exposure to the growth of luxury markets worldwide. Increasing global income inequality continues to benefit brands at the low end of markets and brands at the top. Rémy sells some of the finest Cognacs in the world, with a full range of brands that serve all the segments between premium and upper luxury. Rémy also sells liqueurs, whiskey, gin and rum, but with a more limited range. In sum, Rémy has a set of global brands which are nearly impossible to replicate, some in excess of 300 years old. This is a vital and insurmountable moat that Rémy can lay claim to; no amount of money can replicate Rémy’s business.

Rémy is well positioned to benefit from an increasingly discerning consumer base situated in high-value, fast-growing categories, which offer the potential for greater margin expansion as Rémy’s substantial operating expenditure (OpEx) abates in the coming years. Compared to its peers, Rémy is far more conservatively leveraged, a symptom of majority family ownership that further separates it from its peers.

Rémy’s valuation has fallen significantly over the last two years, faster than the broader industry and has also faced the same headwinds, an uncertain macro outlook, rising inflation and highly restrictive Chinese lock-downs, which have hit revenues. Despite the ultimately short-term issues that have plagued the industry, we take a longer-term view of Rémy’s potential as a well-run family-controlled company that provides unique exposure to growing affluence, particularly in Asia.

Introducing Alibaba

Alibaba Group, a Chinese conglomerate, has built an ever-expanding ecosystem covering an enormous segment of Chinese economy, including domestic/international e-commerce, logistics, digital banking and payment, cloud computing and digital media & entertainment. Its 2014 IPO shattered all records becoming world's largest IPO at the time. Yet the company has been under scrutiny since 2021 largely due to the tighter regulations imposed by the Chinese Government - especially after its once high flying founder, Jack Ma, publicly chided the country's financial system in October 2020. Its share price plummeted more than 60% thereafter. We added Alibaba to the portfolio in 2021 and subsequently increased this position as we believe Alibaba to be significantly undervalued relative to our assessment of its intrinsic value. To learn more, read our Alibaba Investment Summary Report.

Introducing Moncler

Moncler is a textbook example of how a luxury brand can leverage its history while simultaneously embracing new ideas in order to reinvent itself for a new generation. Poised to be one of the top global luxury outerwear manufacturer, Moncler shows few signs of slowing down during an economic downturn. Investors in the Elevation Capital Global Shares Fund hold an investment in Moncler. We added Moncler to the portfolio in March 2022 during the market sell-off, as we believe Moncler to be undervalued relative to our assessment of its intrinsic value. To learn more, read our Moncler Investment Summary Report.

Sauron is watching…Introducing Palantir

Palantir, a company that renders large strands of data accessible and understandable, is the operating system for governments and large enterprises. Palantir's links to Deep State stem from a 2004 investment from the CIA's venture capital fund and the company has since rapidly increased its commercial client base, alongside its government contracts. Investors in the Elevation Capital Global Shares Fund hold an investment in Palantir. We added Palantir to the portfolio in 2021 and subsequently increased the position during periods of market weakness, as we believe Palantir to be considerably undervalued when one considers its long runway of growth in an hostile geopolitical environment. To learn more, read our Palantir Investment Summary Report.

Further Iconic Fashion Houses added to the Portfolio

There are few fashion houses more iconic than Gucci, Saint Laurent and Balenciaga - all of them have left an indelible impact on fashion from the mid-20th Century till today. One unlikely company owns all these iconic houses: Kering S.A. The company began life as a timber trading company in 1963, and has since become a luxury conglomerate. Investors in the Elevation Capital Global Shares Fund hold an investment in Kering. We once again added Kering to the portfolio during the market sell-off in February 2022, as we believe it is deeply undervalued relative to its intrinsic value and luxury peers. To learn more, please read our Investment Summary Report by clicking the link below.

The Exceptional Economics of Hermès

Investors in the Elevation Capital Global Shares Fund own shares in Hermès International S.A. (RMS: ENXTPA), a leather good, luxury powerhouse best known for its infamous Birkin and Kelly Bags. Hermès is the epitome of luxury, offering premium goods such as bags for men and women, ready-to-wear garments, and accessories. Rising to prominence in the late 19th century as a saddlery manufacturer, Hermès has reigned supreme for six generations operating 315 exclusive stores and employing 15,000 artisans, who must each progress through a two-year training program before they are permitted to begin working with Hermès leathers. Performance over the last 10 years has been nothing short of exceptional and we believe that Hermès recent market de-rating provides investors in the Fund an attractive entry point to a business with exceptional margins, returns on capital and future prospects. To learn more, please read our Investment Summary Report by clicking the link below.

Warner Brothers Discovery ushers in a new era of “Content Kings”

Just some of the content the Warner Brothers Discovery (WBD) owns.

One of the recurring themes of the Elevation Capital Global Shares Fund is IP (intellectual property). We love it. In our previous post, Content is King (and Undervalued) we wrote:

…the comparatively outsized impact legacy media has on popular culture and the zeitgeist (AT&T subsidiary HBO produced the show of last year, Succession; whilst ViacomCBS owned subsidiary Paramount produces arguably the second most important television show, Yellowstone; also consider the sheer amount of IP legacy media owns – everything from Mickey Mouse (Disney) to Star Trek (ViacomCBS) to The Wire (AT&T).

We love IP because it’s endlessly reusable; the value of Mickey Mouse is incalculable. The value of a library of content is also almost always underestimated – consider a movie like Ocean's Eleven. The 2001 Ocean’s Eleven reboot made US$450 million at the box office - but - like they say on the Shopping Network - “...and that’s not all”: the entire franchise has made US$1.4 billion at the box office (and even that’s not all – consider the streaming royalties ad perpetuum as a whole new generation discover the franchise years after it was produced). Warner Brothers Discovery, incidentally, owns the IP to Ocean’s Eleven and thousands of other movies, television shows, and related ephemera.

Children’s IP is even better. Consider Harry Potter. Harry Potter is one of the top grossing franchises of all time – grossing US$7.8 billion at the box office. Yet consider the new crop of children who are introduced to Harry Potter every seven years or so; that’s a whole new revenue stream. Or consider the limitless merchandising rights afforded by such valuable IP – the Wizarding World of Harry Potter (Orlando, Florida) is only the beginning. There’s trading cards, lollies, video games, clothing. You name it; someone has monetised it. In effect “evergreen” IP like this actually generates streams of recurring revenue, despite the initial investment often being made many years ago.

Our renewed focus on IP at present is because on Friday, 8 April 2022, the merger between Discovery Communications and the spun-off media unit of AT&T, Warner Brothers, took effect. We have owned fractional interests in both AT&T and Discovery in the Elevation Capital Global Shares Fund (“the Fund”) for this very reason – as of today investors in the Fund now own an interest in the new company: Warner Brothers Discovery.

This means investors in the Fund are now the proud owners of a global content behemoth. Warner Brothers Discovery (WBD) owns a lot of IP – from Ice Road Truckers to the hit TV series Succession to the DC Comics Franchise. It places WBD nearly on par with Disney, as illustrated in the graphic below:

We referenced in “Content is King (and Undervalued)” how consolidation is the likely, and perhaps inevitable outcome for studios. The cost of creating content simply keeps scaling, and to compete effectively (with pricing power) one’s studio needs to be a colossus. The resulting company is just this - WBD becomes a powerhouse of content (especially in terms of library) that can compete in today’s incredibly competitive media landscape. Investors in the Fund also own fractional interests in Paramount and Disney; if we were to own each company “whole” this would represent a ~51% interest in the total annual content consumed in the US alone.

The challenge now for WBD is to enhance its streaming platform to compete with that of Disney+ and Netflix (this is also the challenge which Paramount faces). The challenge is highlighted in the chart below – which details the demand shares for streaming catalogs – here WBD sits in third place; which illustrates just how effectively Netflix and Hulu (owned by Disney and NBC) have rolled out their platforms.

Despite its scale, Netflix is still at a disadvantage – early in its transition to a streaming platform it licensed shows from studios (Warner and Discovery among them) when the studios did not realise the value of their catalogs. Now the studios do, and they are pulling their content from Netflix as their license agreements expire; Netflix is disadvantaged in an “arms race” for content, unlike studios with a large library of valuable IP. Without a doubt there is an “arms race” for content — WBD is set to outpace Netflix’s content spend in aggregate, coming in second to only Disney. The difference between Netflix and WBD is IP — WBD has a vast library of hundreds of thousands of hours of content and incredibly strong franchises. Netflix is still building their IP library — it is an uphill battle in our view.

Source: Purely Streamonomics

Whilst there is an “arms race” between every major studio, the real challenge for WBD is to leverage their immense content library and render it to a streaming platform which provides access to all of WBD’s stellar content. The goal is conversion of audiences to an on-demand platform. We can’t help but feel WBD has been dealt a “royal flush” — with content from the likes of HBO, Discovery and the DC Franchise WBD has a veritable goldmine of IP — and content remains King. We are watching how CEO David Zaslav steers this incredibly exciting new company – and we can’t wait to see the new season of Succession (an HBO production, as it happens).

The Insatiability of Inflation.

One of the metrics we look at when we acquire a fractional interest in a company is its Return on Invested Capital (ROIC). Think of it as what management actually returns on the capital employed in a business – a company that consistently returns +15% on capital employed is going to be a very attractive business in the long run. For instance, Hermes returns +16% on capital employed - this is part of why we acquired shares in Hermes for the Elevation Capital Global Shares Fund portfolio, combined with heavily aligned management – the Dumas family owns over 50% of the company, and an unassailable product – if you want to beat inflation, just buy a Birkin! — see chart below.

Source: Baghunter

Inflation’s insatiability, is the subject of the post. As of February 2022, inflation in the US is estimated to be ~7.9%, whilst in France it sits at ~4.5%. In New Zealand, inflation currently sits at ~5.9% (as of March 2022). In fact, all current estimates now peg global inflation to be higher – you don’t need to be an economist to notice just how expensive the costs of basic goods at the supermarket have become in the past year.

No business owner is a fan of inflation. We think of ourselves as business owners, with fractional interests in a variety of businesses. The problem is that inflation eats away at “actual” returns. Warren Buffett calls this a “Misery Index”. For instance, Hermes earns a return on invested capital of +16%. This is wonderful and should be lauded; we wish all businesses could do this. Yet factor in inflation, and the “real return” becomes ~11.5% (it’s even worse if you use US inflation as your yardstick – it reduces what was once a great return to a pallid ~8.1%). In an inflationary environment, even the best businesses look merely good and good businesses look mediocre — and as for average businesses – well – they’re effectively returning nil.

In an inflationary environment the Return on Invested Capital (ROIC) by even the best business becomes poor. Consider the average ROIC for the S&P 500 – it sits around ~9%. Factor in inflation, taxes and other costs associated with transferring earnings to the owner’s pocket and the ROIC is practically zero today.

We do not have a solution to this. Central Banks around the world appear to be reducing their balance sheets, raising interest rates, and taking steps to curb inflation’s insatiable rise. In the meantime, it appears to us that the only solution is to own companies which earn substantially higher returns on capital than their peers and the market at large.

As a thought experiment, let’s take a few of “our” companies, and compare them with their “real” return (ROIC minus inflation): Meta: +20.9%, Estee Lauder: +9.3%, Visa; +7.9%, Autodesk: +6.3%. In non-inflationary environments, of course, these companies generally all have double digit returns on invested capital. Double digit returns act as a growth engine in non-inflationary environments (to paraphrase Charlie Munger: after 20 years, with a double digit ROIC, you’re going to end up with a hell of a result). In inflationary environments they act as a cushion against the perils of a rapidly devaluing money supply. In our view, owning companies which produce an above-average return on invested capital is the only rational insurance on your own capital in an inflationary environment.

Accordingly, in the Elevation Capital Global Shares Fund, we are focused more than ever on acquiring fractional interests in companies which generate an above-average return on invested capital; acquiring them at an attractive price, and letting the businesses do the rest.

Introducing Universal Music Group

Investors in the Elevation Capital Global Shares Fund own a share of Universal Music Group N.V. (UMG), the world’s largest record company, with +32% of the world’s total music revenues. There are few things surer than the predilection of humanity for music. It is the shorthand of emotion, as Tolstoy once quipped. To own UMG is to earn a “royalty” on people listening to music, something we are certain is bound to continue til the end of time. As streamers such as Spotify have matured, music industry revenues have recovered to near-early 2000s levels and a symbiotic relationship has developed between streaming platforms and record companies that is mutually beneficial (investors in the Global Shares Fund own both sides of the transaction via our investment in Spotify). The crown jewel in UMG’s crown is its extensive catalogue of music, ranging from Bob Dylan to Sting to “ol’ blue eyes” himself, Frank Sinatra. We believe UMG, with its rich catalogue, is well positioned to continue earning a royalty on one of humanity’s timeless pleasures -- music.

How do wars and crises affect equities? Some counterintuitive data.

There is little point in beating around the bush. Stock markets have been subject to heightened volatility. The short-term results aren’t pretty. Even “value”-orientated portfolios have been subject to “market forces”.We are constrained by our mandate – we cannot short (and would not want to anyway) or engage in derivatives. This is most likely a good thing if history is any guide – the investor who invested their portfolio into US equities on the eve of WWI would’ve seen their portfolio rise, on average, ~47% between 1914 and and 1923. A similar scenario occurred during WWII – UK equities outperformed gold from 1939-1948. In other words: hedging and derivatives might window-dress returns in the short-term but in the long-term a diversified equities portfolio delivers a more than satisfactory return.

The volatility is due to Ukraine. As of writing Putin has engaged in a full-scale invasion of Ukraine. The US and its NATO allies have responded by imposing sanctions on Russian banks, and have restricted Russia’s sovereign debt and trade apparatus. Germany halted the pipeline Russia was building to transport natural gas; to which former Russian president Dmitry Medvedev tweeted “welcome to the new world of expensive natural gas, Europe!”

Biden’s sanctions are typical of the US. They cause the greatest harm to Europe (the US has ample natural gas pipelines). They aren’t an incentive for Putin to cease invading Ukraine – the harm caused by cutting off Russia’s vast natural resources has a greater effect on the rest of the world.

The good news is – history suggests that holding (and adding to) equities during a war still results in outperformance against all other asset classes.

We do not know what the future holds but we can look to history for what markets do in times of crisis. For instance, if you were to invest in the Dow Jones at the start of WWI (1914) and hold until the end of the war (1918), your compounded returns would’ve been about +8.7% per annum; or +43% total return.

If you were to do the same with US equities in WWII, your compounded return would have been +7%. If you held UK equities rather than gold in WWII (the equities of a nation crippled by WWII) you would’ve handily outperformed gold, a traditional safe-haven asset.

We recently read David Lough’s “No More Champagne: Churchill and his Money” (spoiler alert: Churchill was a world-class statesman and a world-class spender). Churchill flitted around with equities in WWI and at the outbreak of WWII; he was always looking for the “next big thing” and selling his previous holdings - often at a loss. If only Churchill had simply held a basket of equities for the duration of either war!

What about conflicts of more recent times? During the Korean War (1950-53) the Dow delivered an astonishing +16% return annualised, whilst during the Vietnam War (a prolonged, messy and expensive conflict if there ever was) the Dow delivered a return of +5% annualised. Two months after 9/11 the stock market returned to pre-9/11 levels.

The commonality throughout all these conflicts and wars is that volatility was priced-in early on. The anticipation of conflict caused a sharp drop in market indices, whilst the first month or two of said conflict led to panic selling as market participants adjusted to new information, as illustrated in the chart below:

Source: AMP Capital

A few interesting points to be made, then. The first is that the more serious and involved the war the longer the market takes to resolve itself - but it does resolve. In a diplomatic crisis (i.e. Cuba) the market resolves itself hastily. Even the Iraq war – an event over which an endless quantity of ink has been spilt - resolved itself with comparative speed in the eyes of the US equities markets.

S&P 500 and associated wars and crises

Source: Investmentoffice.com

Another compelling case for investment in equities (in other words, assets that earn capital in very real terms) comes from examining the S&P 500 since during several major wars and crises. The index has steadily maintained its upward incline in the face of wars and crises. This is no secret. The benefits of indexes or being fully invested in equities have become dogma - it is clear for all to see - yet it is remarkable how this wisdom is forgotten in times of war and crisis.

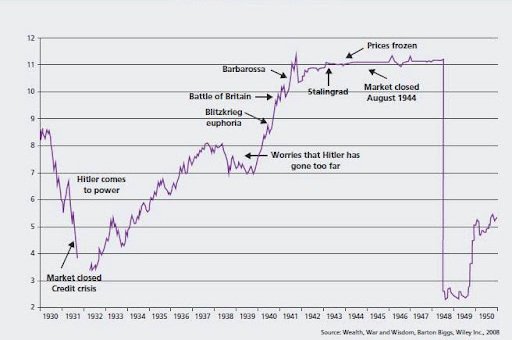

Charlie Munger likes to say “invert, always invert” - so it’s interesting to look at the flipside of WWII, from the perspective of not the US or UK equity markets but those of the eventual loser of the war – Germany. How did they fare?

German CDAX Index: 1930 - 1950

Source: Wealth, War and Wisdom (Barton Biggs)

The results are interesting – the German CDAX (an index of all stocks listed on the Frankfurt stock exchange) reacted very much the same to WWII as the Allied powers did. It suggests that market participants in a war react the same to material news regardless of which “side” they are on: all is fair in love and war. The other remarkable thing is that post-WWII German stocks recovered relatively quickly - by 1950 German equities were unscathed by one of the most terrible wars in history.

German CDAX Index: 1840 - 2010

Source: CDAX

Of course, nobody knows the future. Yet what is clear from the current Russia-Ukraine conflict (and the accompanying response from the US, the Eurosphere and Anglosphere) is that a high amount of volatility has already been priced in. If history is any teacher, high quality equities (real companies which generate actual earnings) remain the best way to take part in the economic success story of the world.

Universal Music Group — Music is Universal

There are few things surer than the predilection of humanity for music. It is the shorthand of emotion, as Tolstoy once quipped. All societies throughout history have developed their own musical language; whether it stemmed from the lyre (ancient Greece), the lute (medieval Europe) or the well-tempered clavier (an absolute game-changer that gave birth to the modern piano and in a way, all music that came after it). Warren Buffett’s case for investing in Gillette was famously simple: most men shave, and most men will continue to shave ‘til day dot. Our thesis on UMG is similarly simple: Music is Universal.

Universal Music Group (UMG) is one of the “big three” music publishing companies (the other two are Warner Music and Sony). Like its brethren it is the result of decades of industry consolidation and hence it is a diverse collection of assets which management has pieced together into a coherent whole (whilst UMG’s origins stretch back to Decca Records, in 1934, its various assets has, at points, been owned by Panasonic and prior to that Seagrams, the distiller). UMG now holds a 32.1% market share globally, which makes it the largest in the industry. It also is the only publisher to have consistently grown its revenues from 2018-2021, largely due to its embrace of streaming and modern mediums of music consumption (Spotify and the other streamers, TikTok, music licensing on memes and so on).

We like industries which have been subject to consolidation, especially ones that are progressing towards an oligopolistic structure. Industries at their birth are often dense with competition. In 1896, when the bicycle became popular there were 140 publicly listed companies engaged in the manufacture of bicycles; by 1901, 40 of those had gone bankrupt and over the next ten years another 60 had gone out of business. The invention of the bicycle was a significant advance in technology (in some ways, it was the most egalitarian advance in technology since the printing press – no fuel needed and relatively cheap and accessible). Yet a significant new technology is no guarantee of a successful business. The more businesses engaged in a new technology, the more competition, and the less chance the business will produce what we are all interested in at the end of the day – significant cash flows.

The catalyst for the recorded music industry were the twin inventions of the radio and recorded sound (first on wax cylinders which quickly evolved to vinyl discs). The two were bound together tightly; recorded sound allowed for the first time in history for music to exist outside of the present. Radio allowed for the effective “streaming” of it in a way which allowed almost unlimited distribution. The fortunes of the two industries were, for a time, linked at the hip. There were numerous recorded music companies and numerous radio companies. Both industries consolidated; for instance CBS transitioned from a radio station operator to a TV company, as did NBC. Decca (the historical precursor to UMG) merged with Universal-International and later MCA. Now the music industry has consolidated further resulting in the “Big 3” and the other side of the transaction – now streamers, not radio – are consolidating, too. There are therefore two catalysts that inform our view of UMG: the wider consolidation that has largely resulted in oligopolistic market share, and the virtuous nature of the other side of the transaction - streamers - and industry consolidation continuing amongst these players.

A virtuous cycle

There are two sides to a music transaction; the ownership of it and the distribution. The ownership of the song/track by the record company (often in tandem with the musician’s own company) is broken into two parts - the “master” rights and the “publishing” rights. The record owner of the rights receives royalties in three ways: mechanical royalties (.ie. the reproduction of the work; this is where revenue from streamers occurs), public performance royalties and synchronisation license fees (i.e. when a work is used in any derivative fashion; think of the sample in Vanilla Ice’s “Ice Ice Baby” which is taken from Queen’s “Under Pressure” - every time “Ice Ice Baby” is played, the owner’s of “Under Pressure” get a royalty too).

Streamers, like Spotify, which investors in the Elevation Global Shares Fund own a share of, receive revenue from their subscribers; in turn Spotify pays a proportionate royalty to the rights owner; often this is UMG. This is counted as a ‘mechanical royalty’. Other popular apps - like TikTok - pay a performance royalty when users make content which uses a song.

We quite deliberately own both ends of the transaction. Investors in the Elevation Capital Global Shares Fund own UMG via a direct holding, but also through our ownership of Tencent (the Chinese technology stalwart that owns 20% of UMG) and Prosus (a South African holding company which owns 28.9% of Tencent, and Vivendi, which spun-off UMG in 2021 and continues to hold a 10% stake). We also own Spotify (and we published research on it in April 2020 and an update in July 2020).

Why do we own both sides of the transaction?

The reason is quite simple. The two are correlated; the more people who stream music, the more royalties UMG will receive.

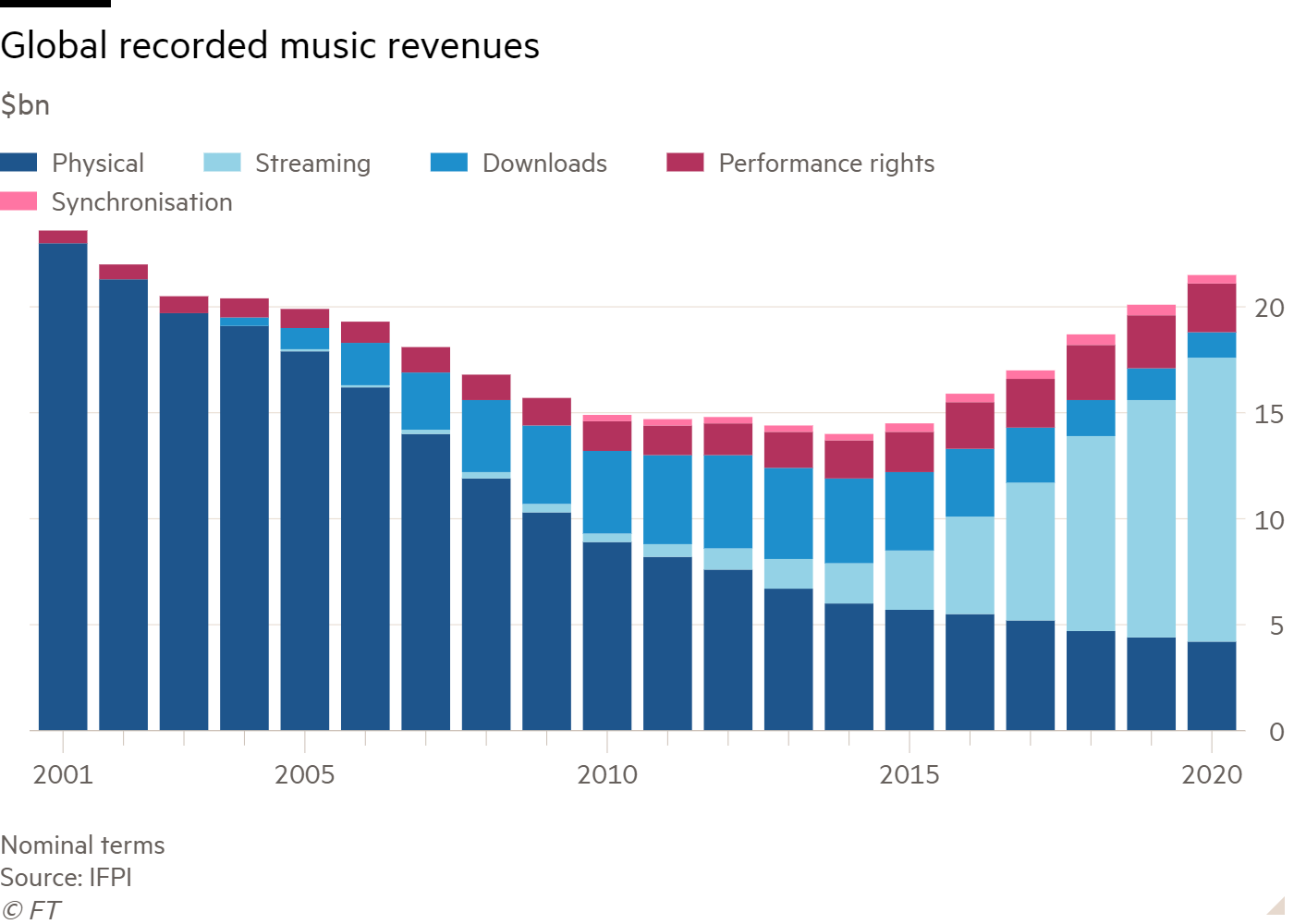

Source: Financial Times

The music industry has gone through two major disruptions in the last twenty years. The first is the “death” of the physical format - the CD - and the ascent of downloaded music. The second was the “death” of downloaded music and the ascent of streaming. Something happened between the 2000s and years following; total revenues declined, hitting their nadir in 2014. It’s important to understand what happened to understand what occurred next: in effect, the record companies didn’t know how to pivot towards a new digital era. Pirating of music was rife but also downloading music is a laborious process compared to a streamer, where millions of songs sit at your fingertips. The industry had continued to pour the bulk of its efforts towards the physical format (CD’s), which was a dying format – the iPod had seen to that. Secondly, the music industry couldn’t quite profit from downloads enough. The frequency wasn’t great enough.

Streaming changed this. Music industry revenues have now recovered to their early 2000s heyday directly proportional to the number of users on the various streaming platforms – Spotify, Apple Music, Tidal, YouTube Music, Amazon Music, etc. The secret is the increase in frequency – whilst streams pay mere fractions of a cent per song play to the record company, the frequency is much greater. This bears many similarities to the co-dependent relationship of recorded music and radio which occurred at the advent of the medium. In other words, it’s full circle: streaming is radio, and the two are highly correlated.

Well positioned

We aim to not make hyperbolic statements and claim something is the “greatest” in its field. Leica is undoubtedly a great camera brand yet the best selling “camera” is the smartphone. As we have mentioned previously, the recorded music industry has a “Big 3” which all benefit from the same base advantages. UMG has the same advantages that both Sony Music and Warner Music have. However, UMG is slightly unique. The first is that it still retains a meaningful stake in Spotify (~3.4%). Sony Music has reduced its holding in Spotify to ~2.0% and Warner Music sold its stake entirely. UMG also owns ~1.0% of China’s most popular streaming service - Tencent Music. It is clearly in UMG’s best interest for streaming to succeed; as streaming’s fortune rises, so do those of UMG, and vice versa. It also means UMG has “skin in the game”; contrast this to that of the comparatively distanced approach record companies had to downloaded music in the first iteration of non-physical music.

The other quality that distinguishes UMG from its competitors is a technology-led commitment to the future. The company moved its headquarters from New York to LA, in a bid to be closer to the heart of the technology sector, as well as engaged proactively in agreements with next-generation services that use its content, like TikTok. It is easy for this to come across as corporate double-speak yet mediums like TikTok are more than hype; performance royalties have become a meaningful aspect of music industry royalties.

Finally, there is the most obvious aspect of size. UMG is the largest record company by far. UMG has used this advantage of scale to negotiate favorable agreements with partners such as Spotify, YouTube and TikTok. Their pricing power is obvious – platforms which do not have UMG’s content are missing out on perhaps a third of all recorded music. To once again quote Sumner Redstone: Content is King.